Tax On Social Security Benefits 2025 Rates

Tax On Social Security Benefits 2025 Rates. Simplify tax planning with tap invest's expert insights. Thus, an individual with wages.

Below is a summary of (1) the key inflation adjusted numbers for 2025 from rev. Single filers earning less than $30,000 annually.

2025 Max Social Security Tax Cindie Jewell, As of december 6, 2025—currently, 41 states will not tax social security benefits, and this includes the nation’s capital, washington, d.c.

2025 Social Security Limit Ted Kristin, Spencer cox's proposed budget calls for eliminating state income tax on social security.

Social Security Benefit Tax Limit 2025 Brandon Gill, Currently, tax exemption is available on post office savings interest of up to rs 3,500 on individual accounts and up to rs 7,000 for joint accounts under section 10(15)(i).

Federal Tax Rate On Social Security Benefits 2025 William Harris, Notably, states like missouri and nebraska.

Social Security Benefits Tax Limit 2025 Fiona Jackson, Social security caps the amount of income you pay taxes on and get credit for when benefits are calculated.

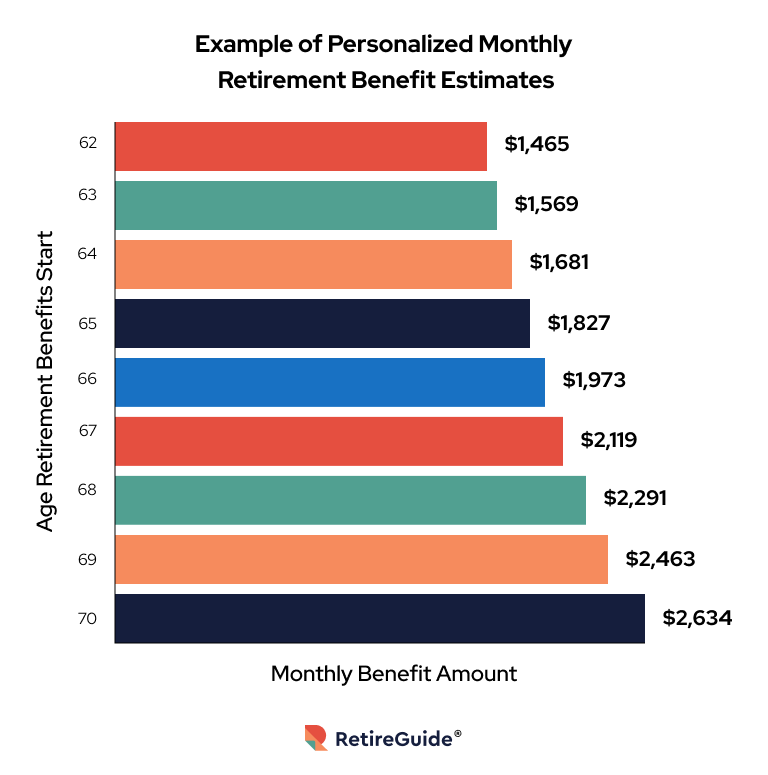

Paying Social Security Taxes on Earnings After Full Retirement Age, Based on these income figures, your social security benefits may fall under varying tax rates.

Social Security Checks To Get Big Increase In 2019, Beginning in 2025, all earned income (defined as wages and salary, but not investment income) between $0.01 and $176,100 is subject to the payroll tax that primarily.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and, This means a larger portion of higher earners’ wages will.